L

o

a

d

i

n

g

.

.

.

Hair Mistakes |

Demystifying Insurance: Exploring Types and Coverage Options

Insurance plays a crucial role in safeguarding individuals, families, and businesses against unforeseen risks and financial losses. Understanding the different types of insurance and coverage options available can empower you to make informed decisions to protect yourself, your loved ones, and your assets.

In this comprehensive guide, we will explore various insurance types and coverage options to help you navigate the complex world of insurance with confidence.

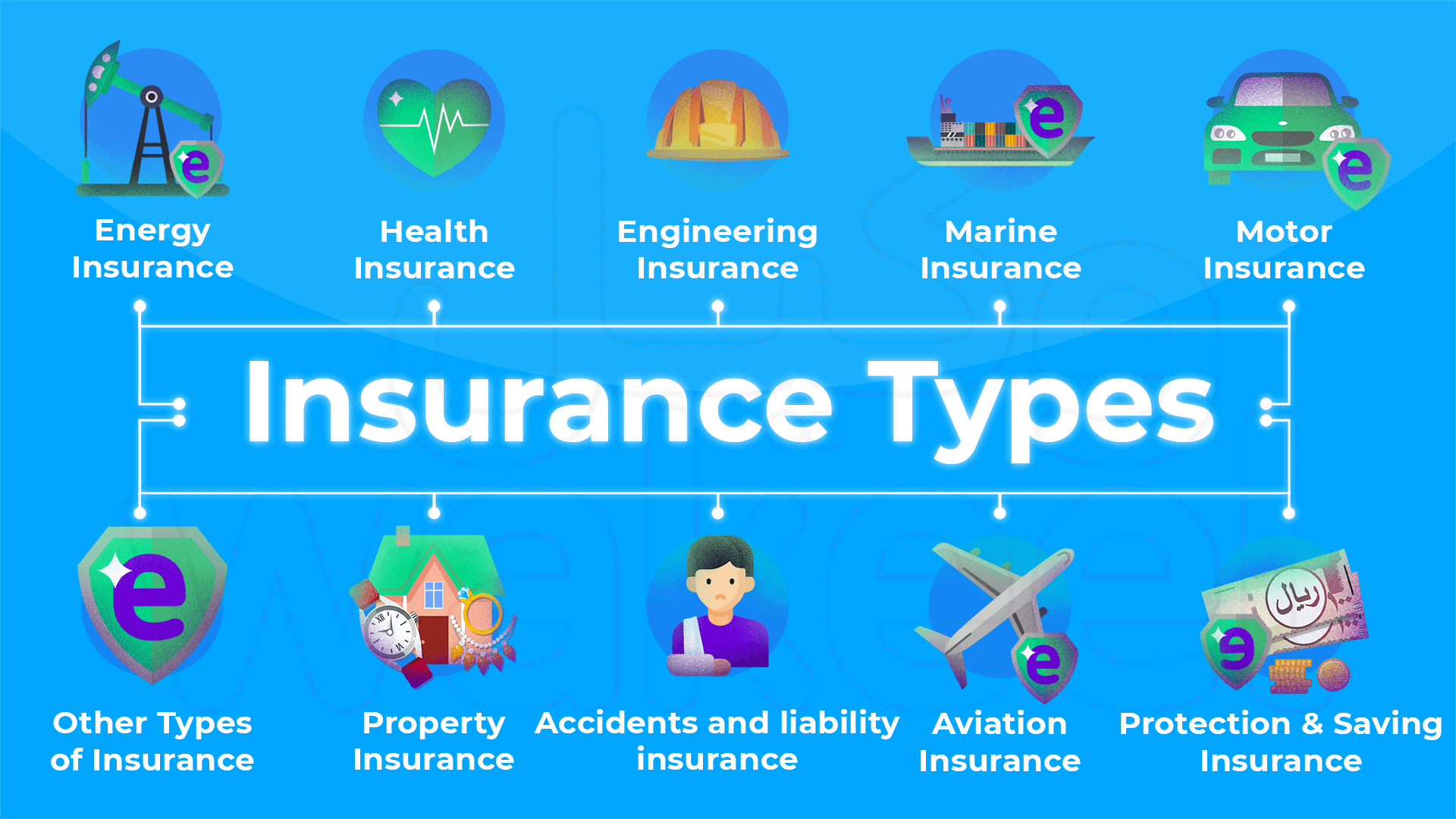

Types of Insurance

Understanding the different types of insurance is crucial for protecting yourself, your family, and your assets from unforeseen risks. Here’s a detailed exploration of the most common types of insurance:

Health Insurance

Health insurance is designed to cover medical expenses incurred due to illness, injury, or preventive care.

Here’s a closer look at its key aspects:

- Coverage Overview: Health insurance typically includes coverage for a wide range of medical services, including doctor visits, hospital stays, prescription drugs, diagnostic tests, and preventive care such as vaccinations and screenings.

- Types of Health Insurance Plans: There are various types of health insurance plans available, catering to different needs and preferences:

- Employer-Sponsored Plans: Many individuals receive health insurance coverage through their employer. These plans are often subsidized by the employer and may offer comprehensive benefits.

- Individual Plans: Individual health insurance plans are purchased directly from insurance companies or through the Health Insurance Marketplace. They allow individuals and families to customize coverage based on their needs.

- Government-Sponsored Plans: Government programs like Medicare and Medicaid provide health insurance coverage to eligible individuals, including seniors, low-income individuals, and people with disabilities.

- Supplemental Plans: Supplemental health insurance plans, such as dental and vision insurance, provide additional coverage for services not typically covered by standard health insurance plans.

- Policy Considerations: When choosing a health insurance plan, it’s essential to consider factors such as premiums, deductibles, copayments, and coverage limits. Evaluating these aspects will help you find a plan that meets your healthcare needs while remaining affordable.

Life Insurance

Life insurance offers financial protection for your loved ones in the event of your death.

Here’s a closer look at its features and benefits:

- Coverage Overview: Life insurance provides a death benefit to designated beneficiaries upon the policyholder’s death. This benefit can help cover funeral expenses, replace lost income, pay off debts, fund education expenses, and provide financial security for surviving family members.

- Types of Life Insurance Policies: There are two main types of life insurance policies:

- Term Life Insurance: Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It offers a death benefit if the insured passes away during the term of the policy but does not accumulate cash value.

- Permanent Life Insurance: Permanent life insurance, such as whole life and universal life, offers lifelong coverage with an investment component. These policies accumulate cash value over time, which can be accessed through policy loans or withdrawals.

- Policy Considerations: When purchasing life insurance, consider factors such as the amount of coverage needed, the length of coverage desired, and your budget. It’s essential to review policy details carefully and compare quotes from multiple insurance providers to find the best value.

Auto Insurance

Auto insurance is essential for protecting you and your vehicle against financial losses resulting from accidents, theft, vandalism, and other covered events.

Here’s what you need to know about auto insurance:

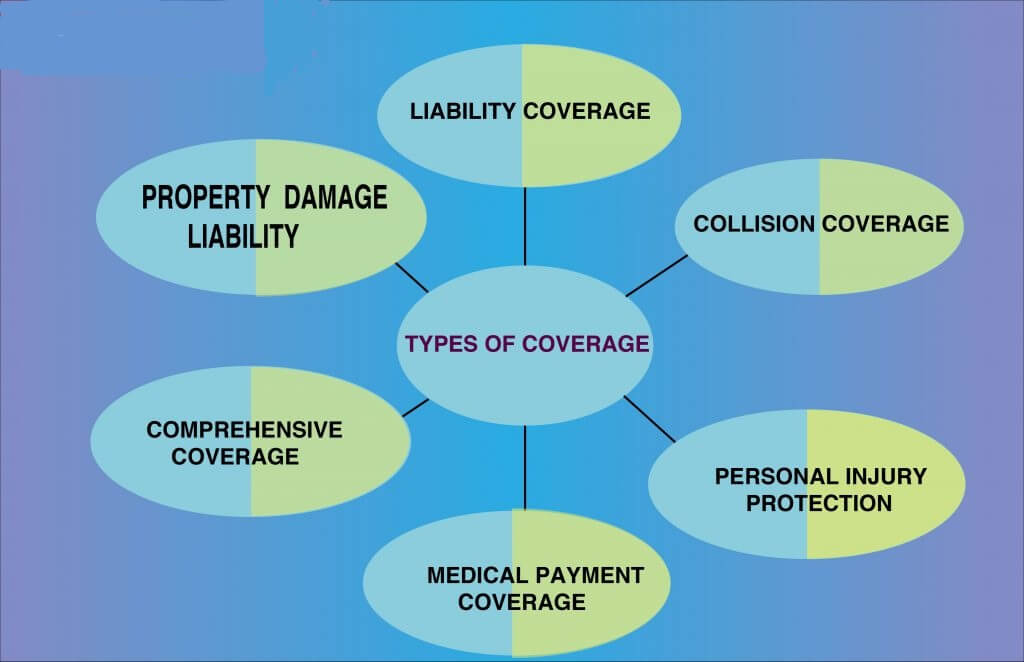

- Coverage Overview: Auto insurance typically includes several types of coverage to protect you and your vehicle:

- Liability Coverage: Liability coverage pays for damages and injuries you cause to others in an at-fault accident. It includes bodily injury liability and property damage liability.

- Collision Coverage: Collision coverage pays for damage to your vehicle caused by a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: Comprehensive coverage provides protection against non-collision events, such as theft, vandalism, fire, and natural disasters.

- Policy Considerations: When shopping for auto insurance, consider factors such as your driving record, age, location, type of vehicle, and coverage limits. Compare quotes from multiple insurance companies to find the best rates and coverage options for your needs.

Home Insurance

Home insurance is designed to protect your home and personal belongings against various risks, including fire, theft, vandalism, and natural disasters.

Here’s a closer look at home insurance coverage:

- Coverage Overview: Home insurance typically includes several types of coverage to protect your property and assets:

- Dwelling Coverage: Dwelling coverage protects the structure of your home, including the walls, roof, floors, and attached structures like garages and decks.

- Personal Property Coverage: Personal property coverage provides reimbursement for the loss or damage of personal belongings, such as furniture, clothing, electronics, and appliances.

- Liability Coverage: Liability coverage protects you against lawsuits arising from injuries or property damage occurring on your property. It covers legal fees, medical expenses, and other costs associated with liability claims.

- Policy Considerations: When selecting home insurance coverage, consider factors such as the replacement cost of your home and belongings, your location’s risk factors (e.g., proximity to flood zones or wildfire areas), and any additional coverage options you may need, such as flood insurance or earthquake insurance.

By understanding the different types of insurance and coverage options available, you can make informed decisions to protect yourself, your loved ones, and your assets from unexpected risks and financial losses.

Remember to review your insurance policies regularly and update your coverage as needed to ensure adequate protection for your evolving needs.

Coverage Options

When it comes to insurance, having the right coverage can make all the difference in protecting yourself and your assets from unforeseen risks. Here’s a closer look at the various coverage options available:

Basic Coverage

Basic insurance coverage serves as the foundation of your insurance policy, providing essential protections against common risks or perils.

Here’s what you need to know about basic coverage:

- Essential Protections: Basic coverage typically includes protections against risks such as fire, theft, vandalism, and liability. These fundamental coverages are designed to provide financial assistance in the event of unexpected events that could result in significant losses.

- Policy Variations: The specific components of basic coverage may vary depending on the type of insurance policy and the insurance provider. While some policies may offer comprehensive basic coverage that includes a wide range of protections, others may have more limited coverage options.

- Reviewing Policy Documents: It’s essential to review your insurance policy documents carefully to understand what is covered under your basic coverage. Pay close attention to any exclusions, limitations, or conditions that may apply to your policy, as these details can significantly impact your level of protection.

Additional Coverage

While basic coverage provides essential protections, additional coverage options allow you to customize your insurance policy to meet your specific needs and preferences.

Here’s what you need to know about additional coverage:

- Customized Protection: Additional coverage options give you the flexibility to tailor your insurance policy to address unique risks or circumstances that may not be adequately covered by basic coverage alone. By adding supplemental coverage options, you can enhance your level of protection and gain peace of mind knowing that you’re adequately insured.

- Examples of Additional Coverage: There are various types of additional coverage options available, depending on the type of insurance policy and your individual needs. Some common examples include:

- Coverage for Valuable Items: This type of coverage provides protection for high-value items such as jewelry, artwork, antiques, and electronics. It typically extends coverage beyond the limits of standard personal property coverage.

- Umbrella Liability Coverage: Umbrella liability coverage offers additional liability protection beyond the limits of your primary insurance policies, such as auto or home insurance. It provides an extra layer of security against costly lawsuits and legal expenses.

- Riders or Endorsements: Riders or endorsements are add-on provisions to your insurance policy that provide coverage for specific risks or situations not covered by standard policies. Common examples include flood insurance riders for homeowners insurance or roadside assistance riders for auto insurance.

- Consulting with an Insurance Professional: When considering additional coverage options, it’s essential to consult with an experienced insurance professional who can assess your needs and recommend appropriate coverage solutions. They can help you understand your options, evaluate the costs and benefits of each, and make informed decisions to protect yourself and your assets effectively.

By understanding the differences between basic coverage and additional coverage options, you can create a comprehensive insurance policy that meets your unique needs and provides the level of protection you require.

Remember to review your insurance coverage regularly and make adjustments as needed to ensure that you’re adequately insured against potential risks and liabilities.

FAQs

Q: How do I choose the right insurance coverage for my needs?

A: When choosing insurance coverage, consider factors such as your budget, lifestyle, assets, and risk tolerance. Evaluate your coverage needs based on your current circumstances and future goals, and compare multiple insurance options to find the best fit for your needs.

Q: What factors affect insurance premiums?

A: Insurance premiums are influenced by various factors, including your age, gender, location, driving record, credit history, type of coverage, deductible amount, and claims history. Additionally, factors such as the value of insured property and coverage limits can also impact premiums.

Conclusion

Navigating the world of insurance can be overwhelming, but understanding the different types of insurance and coverage options available is essential for protecting yourself and your assets. Whether you’re considering health, life, auto, or home insurance, taking the time to evaluate your coverage needs and explore your options can help you make informed decisions and secure the peace of mind that comes with having the right insurance coverage in place.